Top Tips for Starting a Pressure Washing Business in Texas

- Nate Jones

- 6 days ago

- 3 min read

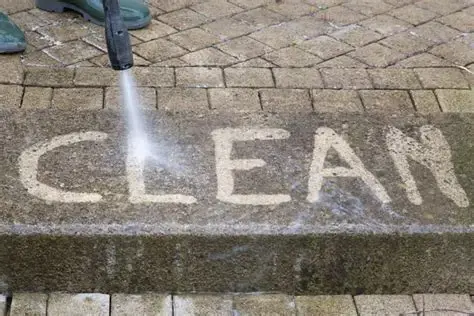

Starting a pressure washing business in Texas can be a profitable opportunity thanks to year-round demand, growing cities, and a strong construction and real estate market. From Houston and Dallas to Austin, San Antonio, Fort Worth, and El Paso, property owners rely on professional exterior cleaning to maintain curb appeal and property value.

Below are essential tips to help you launch and grow a successful pressure washing business in Texas while protecting your investment with the right insurance coverage.

1. Understand Texas Licensing and Local Requirements

Texas does not require a statewide pressure washing license, but many cities have local rules. Depending on where you operate Houston, Dallas, Austin, San Antonio, Fort Worth, or El Paso you may need:

A local business license or registration

Sales tax permit from the Texas Comptroller

Wastewater disposal compliance (especially in larger cities)

Read More: Texas Comptroller of Public Accounts

2. Choose the Right Equipment for Texas Conditions

Texas heat, dust, and storm debris require commercial-grade equipment. Invest in:

Gas-powered pressure washers

Surface cleaners for concrete and driveways

Eco-friendly detergents approved for municipal runoff

High-quality equipment improves efficiency and helps prevent property damage claims.

3. Price Services for Texas Markets

Pricing varies by region. For example:

Houston and Dallas markets are highly competitive

Austin clients often prioritize eco-friendly solutions

San Antonio and Fort Worth see strong residential demand

El Paso requires pricing adjusted for lower population density

Research local competitors and adjust pricing to remain profitable without undercutting your value.

4. Get the Right Insurance Coverage Before Your First Job

Pressure washing involves water pressure, chemicals, ladders, and customer property—making insurance essential. Many commercial clients will not hire uninsured contractors.

Necessary Insurance Policies for Texas Pressure Washing Businesses

Protects against property damage or injury claims.

Protects employees and satisfies hiring compliance requirements.

Required for company trucks, trailers, dump trucks, or vans.

Covers tools, equipment, and machinery on and off the job site.

Provides added protection beyond standard policy limits.

For Texas-based pressure washing contractors, One Hampton Insurance specializes in contractor insurance solutions. Their team understands Texas risks and can help you get the right coverage at competitive rates.

5. Market Your Business Locally Across Texas Cities

Strong local SEO helps pressure washing businesses stand out. Optimize your website and Google Business Profile for searches in:

Houston

Dallas

Austin

San Antonio

Fort Worth

El Paso

Use city-specific service pages, customer reviews, and consistent branding to attract recurring clients.

Optimize Marketing with Contractor Back Office

Contractor Back Office services help contractors manage operations and marketing more effectively. These professional services free up time, improve customer communication, and increase revenue opportunities.

Risk protection matters but Contractor Back Office turns operations into revenue.

Conclusion

Starting a pressure washing business in Texas offers strong earning potential, but success depends on preparation. Understanding local regulations, investing in the right equipment, pricing strategically, and carrying proper insurance coverage will set your business up for long-term growth.

Before booking your first job, protect your business with the right insurance. Contact One Hampton Insurance today for a customized pressure washing insurance quote tailored to Texas contractors

Contact us today.

Comments