Avoid These Common Mistakes in Texas Pressure Washing Businesses

- Nate Jones

- Dec 30, 2025

- 3 min read

Running a pressure washing business in Texas offers strong income potential, but many contractors struggle due to avoidable mistakes. Whether you operate in Houston, Dallas, Austin, San Antonio, Fort Worth, or El Paso, small missteps can lead to lost revenue, damaged property, or legal trouble.

This guide highlights the most common mistakes Texas pressure washing businesses make and how to avoid them.

1. Underpricing Services to Win Jobs

One of the biggest mistakes pressure washing contractors make is charging too little. While low prices may attract customers in competitive markets like Houston or Dallas, they often fail to cover true operating costs such as fuel, equipment wear, and insurance.

Instead, price based on:

Job size and surface type

Risk level and difficulty

Local market demand in cities like Austin or San Antonio

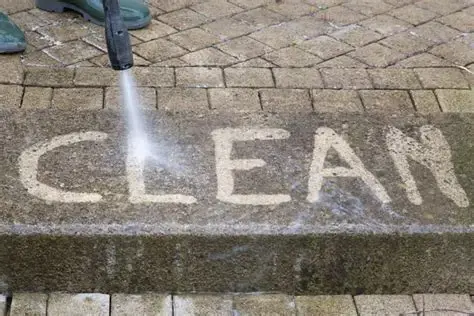

2. Using the Wrong Equipment or PSI

Using incorrect pressure levels can cause permanent damage to siding, concrete, or roofing. This mistake is especially costly in higher-end neighborhoods in Fort Worth or Austin, where property damage claims are more likely.

Investing in professional equipment and proper training reduces risk and improves results.

Read More: Industry equipment safety guidelines

3. Ignoring Local Environmental Regulations

Texas cities may enforce wastewater and runoff rules. Contractors in Houston, Dallas, and San Antonio can face fines for improper disposal of chemicals and contaminated water.

Always check local ordinances and use approved detergents and water reclamation methods when required.

Read More: Municipal environmental compliance resources

4. Skipping Insurance Coverage

Operating without insurance is one of the most dangerous mistakes for Texas pressure washing businesses. Property damage, slip-and-fall injuries, or vehicle accidents can quickly lead to lawsuits.

Many commercial clients in El Paso and Fort Worth require proof of insurance before awarding contracts.

Necessary Insurance Policies for Texas Pressure Washing Businesses

Protects against property damage or injury claims.

Protects employees and satisfies hiring compliance requirements.

Required for company trucks, trailers, dump trucks, or vans.

Provides added protection beyond standard policy limits.

Covers tools, equipment, and machinery on and off the job site.

One Hampton Insurance specializes in insurance solutions for Texas contractors. Their team understands pressure washing risks and can help you secure affordable, compliant coverage.

5. Poor Marketing and Inconsistent Branding

Many Texas pressure washing businesses rely solely on word-of-mouth. Without a strong online presence, you miss potential customers searching in Houston, Dallas, Austin, San Antonio, Fort Worth, and El Paso.

Invest in:

Local SEO and Google Business Profile optimization

Online reviews and referrals

Consistent branding across platforms

Boost Marketing with Contractor Back Office

Contractor Back Office services help contractors manage operations and marketing more effectively through: These professional services free up time, improve customer communication, and increase revenue opportunities.

Risk protection matters but Contractor Back Office turns operations into revenue.

Conclusion

Avoiding common mistakes is essential for building a profitable pressure washing business in Texas. Proper pricing, equipment use, regulatory compliance, marketing, and insurance protection can mean the difference between growth and costly setbacks.

To protect your business from unexpected risks and meet client requirements, contact One Hampton Insurance today for a customized pressure washing insurance quote for your Texas business.

Contact us today.

Comments